Rethinking Digital First

Reducing costs without reducing delight: What started as a benchmarking task became a deeper investigation — revealing that forcing physical cards was driving waste, support calls, and delayed product use.

Overview

Physical cards incur significant costs in printing and delivery, yet we knew asking users to pay upfront would lead to a frustrating experience.

With Nomo being an international bank, it’s normal for the leadership to feel a level of uncertainty about market norms and user expectations.

Selective benchmarking can be a great starting point to align everyone on the team, but that does not mean exploring other options - now is not the right time for solutionizing 💡

Research Questions

How do competitors price and position physical cards?

When do customers perceive physical cards as valuable?

Would introducing friction encourage digital adoption?

Can we reduce printing and delivery waste if demand is lower?

Research Strategy

-

Understand market norms to assess fee viability

-

Determine actual reliance on physical cards

-

Quantify costs, friction & failure points

-

Simplify card activation & enable faster use

Service Blueprint

This is a very abstract top-level view of this activity

Example

Operational inefficiencies and user friction in card issuance

Hundreds of cards are destroyed every quarter due to failed delivery

500+ delivery-related support cases per month

No delivery tracking, high CS dependency

A Large gap between the number of Cards ordered → Card activated

Benchmarking Findings

Physical cards are free in 21/22 cases

Charging for cards is:

Out of market norms

A competitive disadvantage

Friction to funding

Digital-first messaging is standard

Example

Where fees exist

Upgraded cards (e.g., metal or personalized)

Replacement and supplementary cards

In banks offering multiple virtual cards.

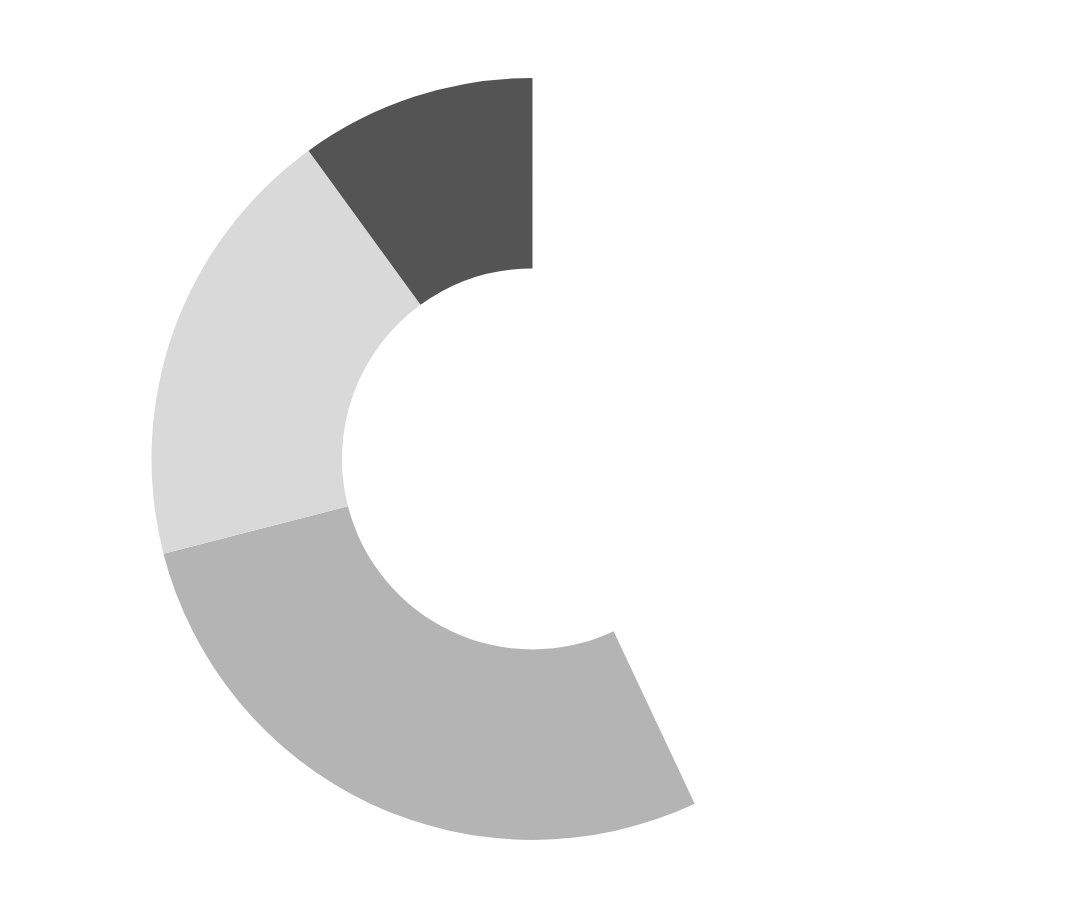

Behavioural Data Findings

We found the mismatch

Originally, this is what the data looked like:

61% total spend is point-of-sale

Physical card POS usage ~ 30%

After a data request to get the Apple Pay APIs:

74% of POS spend on Apple Pay

Physical card POS usage ~ 12%

With the new data:

Digital wallet adoption is increasing month-over-month

Customers already transact digitally

🤔 Something in our journey was discouraging the user’s preferred behaviour

For the nerds: Layering transactional data on top of what was originally a card delivery issue revealed a behavioral layer we weren't aware of, and it required asking more questions, like, who are these 10%?

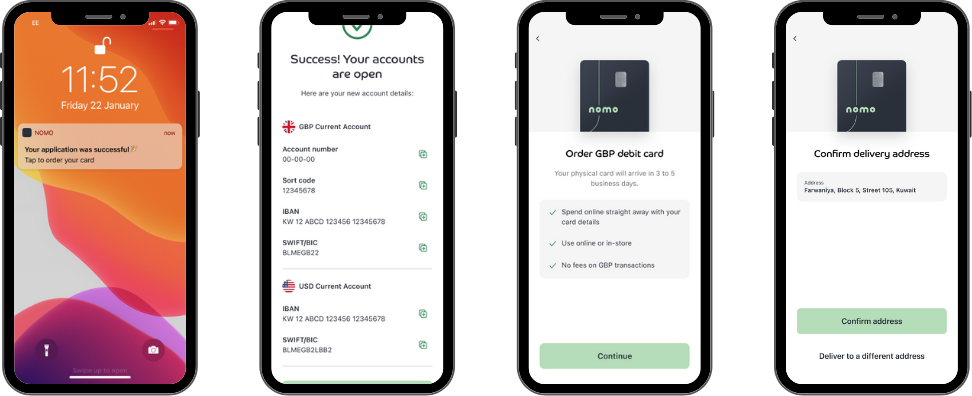

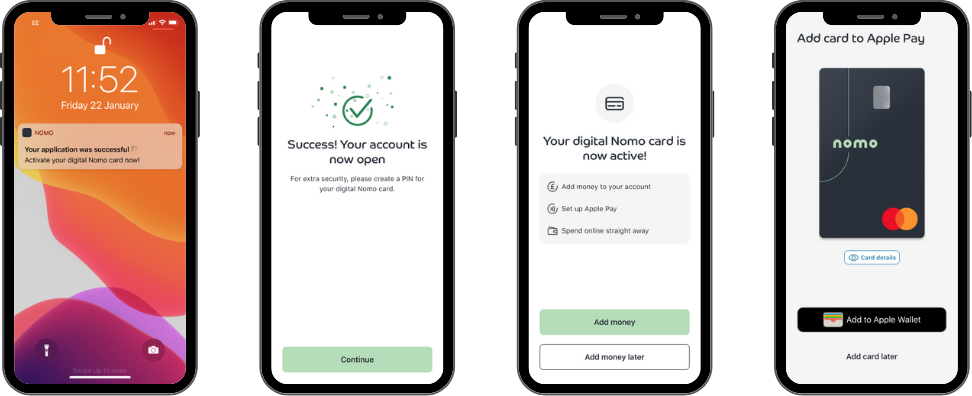

Design Review + Changes

12-Month Impact

76% ↓

Cards ordered per month

89% ↓

Time to first time transfer