Service design transformation reducing approval time by 82% while tripling customer acquisition through systematic process redesign and stakeholder orchestration

Transforming Property Finance: from 5 Months of Frustration to 16 Days of Digital Excellence

Impact Statement

Redesigned end-to-end property finance service ecosystem, reducing approval time from 90 to 16 days (82% improvement) and increasing offers within 20 business days from 41.7% to 73.3%, enabling tripling customer growth from while transforming £57M+ application pipeline efficiency.

Key Success Drivers

Systems Mapping Excellence: Comprehensive service blueprint revealing critical bottlenecks across 8+ stakeholder touchpoints in the property finance acquisition journey

Multi-Channel Orchestration: Integrated broker portal development connecting fragmented Excel-based processes into a unified digital workflow

Operational Transformation: Evidence-based process redesign moving from manual document handling to automated status tracking and batch document upload

Proof Points

Multi-stakeholder research across PF Advisors, Underwriting Team, and PF Officers

Service blueprint identifying end-to-end process inefficiencies

Post-implementation metrics: 82% reduction in approval timeline, 31.6% improvement in delivery consistency

£57M+ application volume successfully processed through redesigned system (Q3 2025)

The Strategic Context

-

Property finance division operating with manual processes, Excel-based tracking, and fragmented stakeholder communication, creating significant friction in a competitive market requiring rapid response times.

-

Critical business constraints limiting growth potential:

5-month average approval timeline vs. industry standard expectations

Manual document management creating processing bottlenecks

Broker frustration with lack of application visibility

Internal stakeholder coordination inefficiencies across advisory, underwriting, and processing teams

-

How might we redesign the property finance service ecosystem to dramatically reduce processing time while maintaining compliance standards and improving stakeholder experience across the entire acquisition journey?

-

Implement comprehensive service design methodology combining stakeholder ethnography, process mapping, and systematic digital transformation to create integrated broker portal and streamlined operational workflows.

Research Strategy and Execution*

Research Strategy and Execution*

-

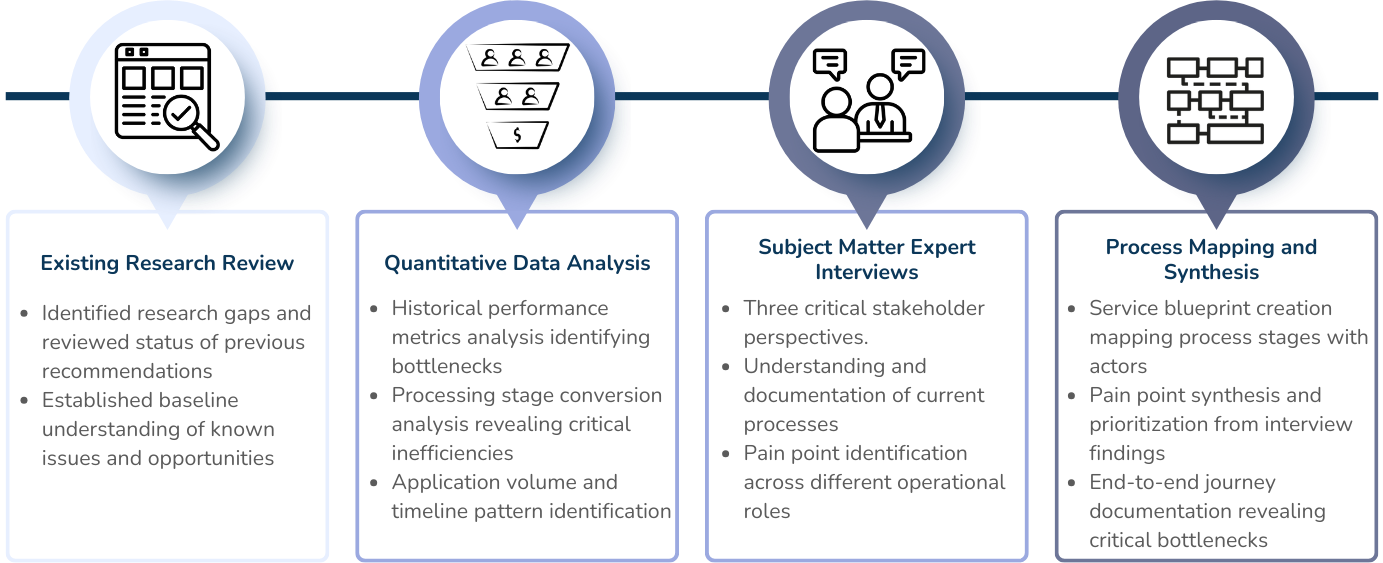

The limited pool of active property finance customers presented a significant constraint for conducting comprehensive user research to understand the full customer journey. Traditional user-centered research approaches would have yielded insufficient sample sizes for reliable insights across the diverse property finance acquisition process. To overcome this limitation, I implemented a research triangulation methodology that combined multiple data sources and research methods to enhance validity and credibility of findings. This strategic approach integrated four complementary data streams: existing research review to identify known gaps, quantitative performance data analysis to reveal systematic bottlenecks, subject matter expert interviews to capture process-level insights from internal stakeholders, and digital experience audits to assess customer-facing touchpoints.

Read more

Service Design Innovation: Ecosystem Mapping: Comprehensive Service Blueprint Analysis

an example of a section of the service blueprint - details are omitted

Critical process inefficiencies identified → Designing a cohesive experience across stakeholder touchpoints → Broker Portal development addressing core pain pointsReflections

How this project refined my practice:

Systems Thinking Application: Developed a framework for mapping complex multi-stakeholder financial processes

Digital Transformation Integration: Created an approach combining service design with technology implementation

Stakeholder Research Depth: Enhanced methodology for capturing operational constraints alongside user needs

Impact Measurement: Established quantifiable metrics connecting service design decisions to business outcomes

How insights transfer to other banking contexts:

Process Optimization: Framework applicable to any multi-stage financial approval workflow

Stakeholder Coordination: Methodology for managing complex internal/external user ecosystems

Compliance Integration: Approach for maintaining regulatory standards during digital transformation

Performance Measurement: Metrics framework connecting operational efficiency to customer experience